By Maria Martinez and Philip Blenkinsop

BEIJING/BRUSSELS (Reuters) -The European Union will set out next month how it will square up to increased geopolitical challenges from Beijing and others amid signs its largest member Germany, once a brake on tougher measures against China, is having a rethink.

In an economic security doctrine to be unveiled on Dec. 3, the European Commission will review its trade defence arsenal and decide if it must do more to deal with threats including China’s squeeze on rare earths and a combative United States.

China will be the central policy focus, as concerns rise about Europe’s reliance on it for critical minerals to drive the green and digital transitions and unfair competition for European companies from subsidised Chinese imports.

Unity will be needed to drive through policy changes that seal and deepen ties with like-minded trading partners or trigger retaliation – something the 27-nation bloc struggled to achieve in response to U.S. tariffs.

Significantly, there are signs that Germany, the EU’s largest member and economy, is coming into line regarding China.

A year ago, Berlin was an opponent of tariffs on Chinese-built electric vehicles. Last week, it established a committee of experts to advise parliament on “security-relevant trade relations” with China, reactivating a “de-risking” push.

Chancellor Friedrich Merz said this month Germany will not allow components from Chinese companies in its future 6G mobile network. He also broke with decades of German free-trade dogma to call for protection for Europe’s steel industry.

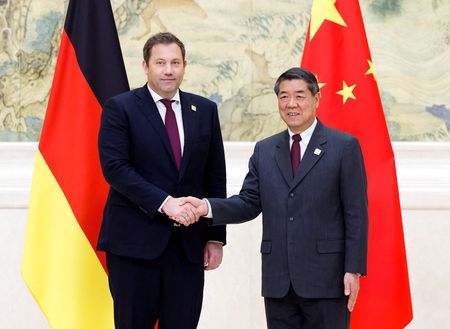

Visiting China this week, Finance Minister Lars Klingbeil raised concerns over Chinese export curbs on rare earths and industrial overcapacities.

“We have learned from dependencies such as those that arose with Russian energy supplies and we are making ourselves stronger in Germany and Europe,” Klingbeil said he told China.

“I am in favour of free and open markets. But I do not want us to end up being the losers in Europe and Germany,” Klingbeil told Reuters in Shanghai.

At a press event with Klingbeil, Chinese Vice Premier He Lifeng said Beijing was committed to joint cooperation and working to “foster a fair, equitable and non-discriminatory business environment”.

GERMAN SHIFT OPENS WAY FOR TOUGHER EU STANCE

China’s weaker economy and its move up the value chain of industrial production mean it is no longer the reliable market it once was for German exports.

The EU’s goods trade deficit with China has ballooned by nearly 60% since 2019, while Germany’s trade balance with China shifted from surplus to deficit in 2023 and continues widening.

EU leaders agreed in October the bloc should “make effective use of all EU economic instruments” to counter unfair trade – such as accelerating the end of the customs duty exemption for low-value parcels, billions of which arrive from China.

Brussels’ December doctrine is likely to highlight export controls, screening of investments and restrictions on foreign subsidies for EU-based operations. Its ultimate weapon, the Anti-Coercion Instrument, can curb imports, exports and investment or access to public tenders.

Germany’s hardening stance could be a game-changer allowing firmer action, said Jacob Gunter of think tank Merics. The EU needs a broad majority of its members to fire up the ACI.

“China doesn’t worry about Europe’s hawkish tone unless it threatens their access to the European market,” he said.

Calls are meanwhile growing to set conditions on Chinese investments in Europe, such as technology transfers – mirroring what China requires from European firms.

“SPAIN-FIRST” APPROACH SEEN AS A RISK TO EU UNITY

EU trade chief Maros Sefcovic said last month the EU wanted “real investments” – an aspiration Brussels will translate into proposals that EU states will need to back.

Just as Berlin cools towards Beijing, however, Madrid is opening up to Chinese investments in renewables, EV batteries and mining. Spanish pork producers have also benefited from lower tariffs than EU peers in a Chinese anti-dumping probe along with a trade protocol that could increase their sales.

King Felipe’s visit last week underscored Beijing’s success in cultivating Spain as a rare EU ally.

Noah Barkin at research provider Rhodium Group said Spain’s China policy was increasingly at odds with the European consensus built in Brussels, Berlin and Paris.

“It is a Spain-first approach that risks undermining EU unity at a crucial moment, when the bloc faces unprecedented economic coercion from Beijing on rare earths and in relation to the chipmaker Nexperia,” he said.

Spain’s Economy Ministry said in response to Reuters inquiries that its dealings with China would remain within the framework set by Europe’s economic security strategy.

“Strengthening cooperation and trade relations between Spain and China also serves to strengthen relations between the EU and China,” it added in a statement.

Nexperia will be front-of-mind as Brussels crafts guidelines on economic security. The Netherlands took control of the company in September over concerns about technology transfer to China, before stepping back after Beijing responded by withholding Nexperia chips needed by German carmakers.

EU officials say they were surprised not to have been given prior warning of the Dutch move, which might have been a trigger for using the ACI.

“The Anti-Coercion Instrument is our sharpest tool, but unity is key: China exploits EU divisions deliberately,” said Ferdinand Schaff, senior manager for Greater China at the BDI industry association.

(Reporting by Maria Martinez in Beijing, Philip Blenkinsop in Brussels, Charlie Devereux, Corina Rodriguez and Victoria Waldersee in Madrid, Toby Sterling in Amsterdam, James Pomfret in Hong Kong, Liz Lee in Beijing; Editing by Mark John and Catherine Evans)