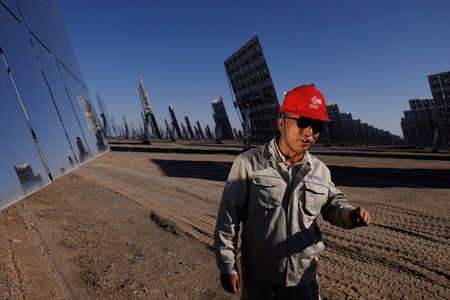

BEIJING (Reuters) -Curtailment of renewable energy flows to balance China’s grid at times of high supply or low demand will present risks to investor revenue over the next 10 years, consultancy Wood Mackenzie said in a new report on Monday.

Solar curtailment rates are forecast to average more than 5% in 21 provinces over the next 10 years, Wood Mackenzie forecast.

That would be up from just 10 provinces experiencing that level of curtailment during January to August this year, according to the most recent data from the National New Energy Consumption Monitoring and Early Warning Center.

Curtailment refers to grid managers limiting the amount of power coming into the network to maintain a balance with demand, or due to grid infrastructure constraints.

The outlook was less dire for wind curtailment rates, which are expected to exceed 5% in seven provinces over the next decade, the report found.

Fourteen provinces saw that level of curtailment in the first eight months of 2025, according to the monitoring center data.

Provinces with higher curtailment rates will find it harder to attract investment under a new power price mechanism that introduces regional auctions in lieu of fixed rates of return, according to Wood Mackenzie’s Sharon Feng, senior analyst for the China power market.

China has a national-level limit of 10% curtailment for renewables, a figure it relaxed last year from 5% previously as it became harder to incorporate rising amounts of renewable energy supply into the grid.

An energy administration official told a press conference on Friday that China will focus on ensuring the integration of renewable power generation into the grid during the next five-year plan from 2026-2030 to achieve its renewable energy goals.

The official cited strategies including encouraging direct corporate power purchase agreements, building more long-distance transmission lines, and promoting virtual power plants, which coordinate energy resources into a single entity so the grid can dispatch them more efficiently.

(Reporting by Colleen Howe)