By Leika Kihara and Makiko Yamazaki

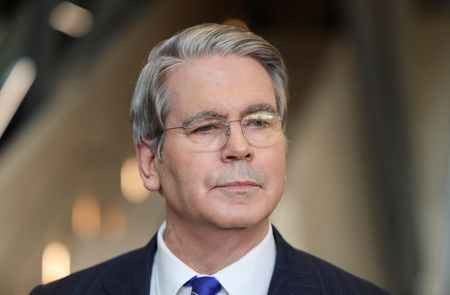

TOKYO (Reuters) -U.S. Treasury Secretary Scott Bessent urged Japan’s government on Wednesday to give the central bank scope to raise interest rates, escalating his warning to Tokyo against keeping the yen too weak through prolonged low borrowing costs.

The dollar fell 0.3% to 151.59 yen after the comments, which revived market expectations of a near-term interest rate hike by the Bank of Japan.

“I am encouraged by her deep understanding of how Abenomics has moved from a purely reflationary policy to a program that must balance growth and inflationary concerns for the citizens of Japan,” Bessent said in an X post about his meeting with Japanese Finance Minister Satsuki Katayama on Monday.

“The government’s willingness to allow the Bank of Japan policy space will be key to anchoring inflation expectations and avoiding excess exchange rate volatility,” he added.

The comments come ahead of the BOJ’s two-day policy meeting ending on Thursday, when markets widely expect the central bank to hold off on raising interest rates.

They also followed a statement by Bessent on Tuesday, which said he called for a “sound monetary policy” in Japan to anchor inflation expectations during his meeting with Katayama.

“Bessent might have felt that without his pressure, the BOJ could keep delaying rate hikes,” said Mari Iwashita, executive rates strategist at Nomura Securities.

“But just raising rates once more won’t move the yen much. I think Bessent is asking for clearer communication on how far the BOJ will eventually push up borrowing costs,” she said.

Bessent’s comments add to complications for the administration of new Prime Minister Sanae Takaichi, who is known as an advocate of expansionary fiscal and monetary policy.

Japan’s top government spokesperson Minoru Kihara declined to comment on Bessent’s X post. “Specific means of monetary policy falls under the jurisdiction of the BOJ,” he told a news briefing on Wednesday.

CONDITIONS ARE DIFFERENT NOW TO ‘ABENOMICS’ TIME

Takaichi was close to former premier Shinzo Abe, who deployed his “Abenomics” fiscal and monetary stimulus policies 12 years ago to pull Japan out of deflation and combat a yen spike that had been hurting the export-reliant economy.

Japan now faces different challenges. With inflation above its target, the BOJ exited remnants of Abenomics last year and raised rates twice through January. A weak yen has become a political headache by boosting import costs and inflation.

“Bessent is correct in pointing out that Japan’s economic and price conditions have changed dramatically from the time Abenomics was deployed,” said Shotaro Mori, senior economist at SBI Shinsei Bank.

“The BOJ understands that well, which means we should brace for the chance of a rate hike in December, or January next year.”

In overseeing Washington’s trade and exchange-rate talks with Tokyo, Bessent has repeatedly signalled his preference for tighter Japanese monetary policy.

Some analysts see Washington pursuing a weak-dollar policy that would boost U.S. exports, thereby applying pressure on Japan to allow the yen to appreciate against the dollar.

(Reporting by Leika Kihara and Makiko Yamazaki; Additional reporting by Kentaro Sugiyama and Takahiko Wada; Editing by Christopher Cushing and Muralikumar Anantharaman)