By Andrea Shalal

WASHINGTON (Reuters) -A total of 165 organizations on Monday criticized South Africa for failing to make progress on debt sustainability issues during its presidency of the G20 major economies and urged it to push for reforms before it hands over to the U.S. on December 1.

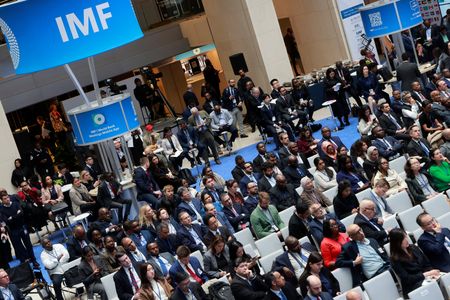

In a letter to South African President Cyril Ramaphosa released on the first day of the annual International Monetary Fund and World Bank meetings in Washington, the groups called for “the cancellation of all unsustainable and illegitimate debts, from all creditors” to protect funds needed for education, health, gender equality and climate resilience.

They also urged the G20 to push for “radical reforms” of debt restructuring processes, back creation of both an African Credit Rating Agency and a “Borrowers Club” to facilitate cooperation among debtor countries, and to push for an agreement to sell IMF gold reserves to set up a debt relief fund.

Developing countries, already saddled with high debt levels, have faced additional burdens given U.S. President Donald Trump’s sweeping tariffs. The World Bank in April said half of some 150 developing countries are either unable to make debt service payments or at risk of getting there.

Total debt in emerging markets rose by $3.4 trillion in the second quarter to a record of more than $109 trillion, according to recent data from the Institute of International Finance.

“Despite some progress under the G20’s Common Framework, current debt arrangements remain inadequate,” the groups wrote in the letter. “Restructuring processes are too slow, debt reductions too shallow, and the sharing of responsibility between public and private creditors deeply unequal.”

Signed by the European Network on Debt and Development (Eurodad), Amnesty International, the Malala Fund and ActionAid International, among others, the letter lauded Ramaphosa’s decision to make debt sustainability one of four priorities for South Africa’s presidency, but said “so far nothing tangible let alone ambitious has been achieved.”

“While this year’s G20 has been put forward as an ‘African G20’, there is no evidence that any progress has been made on the debt crisis facing Africa and many other countries worldwide during the South African presidency,” the groups said, adding that it was not too late for the country to leave its mark.

The United States is due to assume the G20 presidency on December 1, shortly after a leaders summit to be attended by U.S. Vice President JD Vance instead of Trump.

“Developing economies are currently experiencing the highest borrowing costs in nearly two decades while debt payments are crowding out vital domestic resources and diverting them away from development,” the groups said.

They noted that African countries are charged much higher interest rates than countries in other regions with comparable credit ratings and macroeconomic indicators, costing them some $74.5 billion per year in excess interest payments, according to data compiled by the United Nations Development Program.

Failure to address the debt challenges and offer low-income countries decisive debt reductions meant action to address climate change would remain “out of reach” for most countries.

(Reporting by Andrea Shalal in Washington; Editing by Matthew Lewis)