By Duncan Miriri

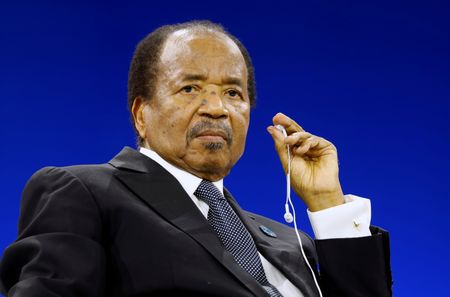

NAIROBI (Reuters) -Cameroon’s voters will decide on October 12 whether to grant 92-year-old President Paul Biya, the world’s oldest head of state, an extension of his four-decade rule. Here is what investors are watching in the race to lead central Africa’s biggest economy:

WHO ARE THE CANDIDATES IN THE ELECTION?

Biya, who has been in power since 1982, is facing a dozen other candidates in an election in which more than 8 million voters are eligible to cast ballots. But at the helm of the ruling Cameroon People’s Democratic Movement (CPDM) party, he controls the electoral machinery and is almost certain to win.

The main opposition challengers include Issa Tchiroma Bakary, a former minister of employment, and Bello Bouba Maigari, whom Biya appointed as his first prime minister when he took power.

But the opposition is more noteworthy for one absence: Maurice Kamto, Biya’s main rival. The electoral commission rejected his candidacy in July without giving a reason.

Kamto secured 14% of the votes cast during the last election in 2018, which Biya won amid fraud allegations.

WHAT ARE THE TOP ISSUES FOR INVESTORS?

Cameroon, like other Sub-Saharan African countries, started issuing Eurobond debt in the last decade, putting it on the radar of frontier market investors.

It issued its maiden international bond in 2015, before tapping the market again last year with an issue that will mature in 2032.

The country also had a $689.5 million International Monetary Fund programme, as well as $181.7 million from the Resilience and Sustainability Facility, both of which ended in July. Investors will be watching to see if it will secure a new arrangement.

Cameroon’s economy is reliant on commodities exports; it is the world’s fifth biggest cocoa producer and also exports oil, gas and timber. This leaves it vulnerable to the vicissitudes of commodity price slumps.

WHAT ECONOMIC CHALLENGES WILL THE WINNER FACE?

The IMF classifies Cameroon’s debt as sustainable – but at high risk of distress. Analysts have warned that its rising reliance on borrowing as well as inefficiencies in its debt management could increase the country’s vulnerability to shocks.

That could pose a problem for the winner as the government seeks to borrow $1.6 billion locally and abroad to plug a financing gap, amid falling disbursements from donors.

Cameroon’s debut $750 million bond also matures next month, which could drain some cash from government coffers, although officials have not yet commented on plans to manage the maturing bond.

The winner will also have to address the financial sector in order to exit the global Financial Action Task Force’s “grey list”, a determination that its system is susceptible to money laundering.

Cameroon has also been dealing with increased climate catastrophes, including droughts and floods, which have pressured the agriculture sector and could curb production of key commodities.

ARE THERE ANY OTHER FACTORS AT PLAY?

Investors also closely watch Biya’s health, as his advanced age and the lack of a clear succession plan, raise concerns over the country’s stability.

Biya would be nearly 100 years old at the end of the eighth term in office he is seeking.

His health is the subject of frequent speculation, and he already often spends long periods of unexplained time in Europe, including last year when he disappeared from public view for a 42-day stretch.

He has brushed off concerns about his health and said he was determined to serve the country.

Cameroon also faces a host of serious security challenges, including a conflict with Anglophone separatists in the southwest and the northwest and threats from Nigeria-based Islamist fighters in the north.

(Reporting by Duncan Miriri; Editing by Libby George and Gareth Jones )