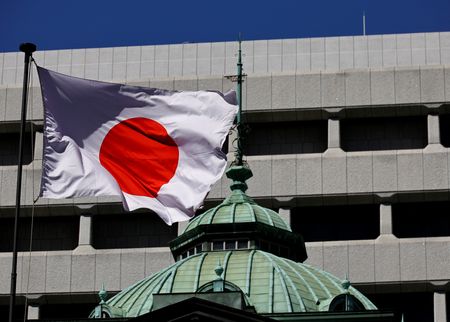

(Reuters) – The Bank of Japan kept interest rates steady on Friday but decided to start selling its holdings of risky assets, taking another step forward in phasing out remnants of its massive stimulus programme.

Two of the BOJ’s nine board members dissented to the central bank’s decision to keep short-term interest rates at 0.5% and proposed, unsuccessfully, to hike borrowing costs to 0.75%.

At the two-day meeting that ended on Friday, the BOJ decided to sell its holdings of exchange-traded funds (ETF) in the market at an annual pace of around 330 billion yen. It also decided to sell real-estate investment trusts (REIT) at an annual pace of around 5 billion yen ($33.95 million).

QUOTES

HIROFUMI SUZUKI, CHIEF CURRENCY STRATEGIST AT SMBC, TOKYO:

“It came as a surprise. With the start of ETF sales and two dissenting votes against leaving policy unchanged (i.e., in favour of tightening), the outcome was hawkish despite expectations for a straightforward hold.”

“In terms of the calendar, even with the LDP leadership election on October 4 and other events ahead, the BOJ signalled that it will proceed steadily with policy normalisation. An additional rate hike is anticipated in October.

“This is expected to put appreciation pressure on the yen against the U.S. dollar (i.e., push USD/JPY lower).”

CHARU CHANANA, CHIEF INVESTMENT STRATEGIST, SAXO, SINGAPORE:

“The dissent from Takata and Tamura highlights growing hawkish pressure inside the BOJ. While the majority still favour a steady path, the presence of two board members voting against today’s decision suggests the debate is tilting toward quicker normalisation.”

“Their stance underscores a gradual shift in board dynamics that could lend yen some support, especially after the post-Fed declines. The BOJ’s roadmap to wind down ETF/J-REIT holdings signals that asset-purchase support is fading.”

“That’s a structural headwind for broad indices like TOPIX/Nikkei, though the impact depends on the pace and signalling of sales. For banks, normalisation, however, could be a tailwind via steeper curves and better NIMs, provided the economic momentum remains steady.”

BEN BENNETT, HEAD OF INVESTMENT STRATEGY – ASIA, L&G ASSET MANAGEMENT, HONG KONG:

“Rates were kept steady, but the announcement of asset sales plus two votes for a hike gave the meeting a hawkish bias. This is particularly the case in light of this week’s rate cut by the Federal Reserve, which could see the yen strengthening as a result.”

MASATO KOIKE, SENIOR ECONOMIST, SOMPO INSTITUTE PLUS, TOKYO:

“The dissenting votes and the ETF decision were quite a surprise. However, given the limited scale itself (on ETF and J-REIT), I don’t think it will significantly impact share prices in the medium to long term. Establishing a clear path forward for ETF handling represents a significant turning point.”

“The BOJ is exploring (a chance of a rate hike by the year-end), and such a possibility exists. Considering future inflation (trends), opportunities for a rate hike are limited, and if Sanae Takaichi is elected (as the head of the ruling party), the likelihood of a rate hike significantly decreases. So taking those into account, there is a degree of intent to signal the BOJ’s stance on rate hikes.”

“Still, it takes time for the data gauging impact on Trump tariffs to emerge, so these contradictory factors will be a challenge going forward (for the BOJ).”

SHINICHIRO KOBAYASHI, PRINCIPAL ECONOMIST, MITSUBISHI UFJ RESEARCH AND CONSULTING, TOKYO:

“The timing of the ETF sale came as something of a surprise, occurring just as Japanese equity markets were hitting fresh highs and investor caution was rising. While it is a negative factor, unwinding ETF holdings is the right step, as a central bank taking on private-sector credit risk is itself an unusual situation.”

“With the prospect of a slowdown in the U.S. economy and further rate cuts on their way, it may become increasingly difficult for the BOJ to move in the opposite direction and raise interest rates.”

“The stance of Japan’s next prime minister on monetary policy following the ruling party’s leadership race will also be closely watched.”

SHOKI OMORI, CHIEF DESK STRATEGIST, MIZUHO SECURITIES, TOKYO:

“The BOJ maintained its policy rate but issued a distinctly “hawkish hold”, with two dissenters and a commitment to keep a close watch on inflation trends, trade policies, and market developments.”

“The release of the statement was notably delayed, an unusual development that heightened speculation that extraordinary measures might be under consideration.”

“The most consequential initiative in the statement was the decision to commence a phased reduction of the Bank’s holdings of ETFs and Japanese REITS (J-REITs).”

“The asset-sale plan is expected to lift short- and medium-term yields by reinforcing expectations of future policy tightening, whereas long and super-long maturities should remain largely guided by term premia rather than the Bank’s immediate actions.”

($1 = 147.2900 yen)

(Reporting by Reuters Asia markets team; Editing by Rashmi Aich)