By Ahmed Elimam, Federico Maccioni and Tim Hepher

DUBAI (Reuters) -China raised its global aerospace presence with a flying display by its C919 jetliner in Dubai on Monday, as Chinese planemaker COMAC pursues a place in a market wrestling with delivery delays at Boeing and Airbus.

China’s first fully-fledged domestic jetliner, in a white livery with blue and green details, displayed its belly-painted C919 logo to dignitaries at the Dubai Airshow in a short but symbolic display of one of Beijing’s key strategic projects.

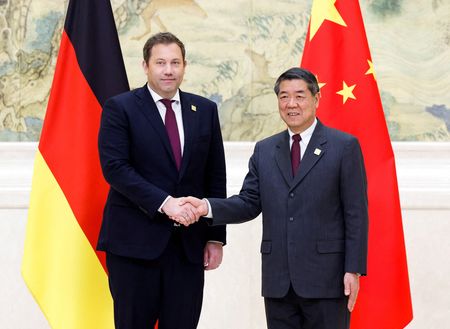

Chinese officials declined to answer questions about efforts to find their first buyer outside East Asia, but their marketing compared the ambitious project to Dubai’s own transformation.

“Where a miracle meets another,” a poster read on a display stand nestled between global aircraft and arms makers at the largest Middle East aerospace event, running November 17-21.

Seventeen years after the C919 was first unveiled, Chinese planemaker COMAC has ambitions to take on Airbus and Boeing or smaller Brazilian rival Embraer.

Although the plane was first displayed at last year’s Singapore Airshow, its two existing models – the C909 and C919 – lack key certifications from Western regulators and COMAC is looking for alternative markets to help boost its profile. CHINA’S ANSWER TO THE AIRBUS A321NEO, BOEING MAX 10 Dozens of people lined up to see the C919 in Dubai on Monday, while a pilot chatted about his experience operating it.

Inside the halls where business is done, COMAC highlighted plans for a family of aircraft to compete with the stables of different models from Airbus and Boeing.

These include a longer version of the C919 dubbed the Stretched Variant, which COMAC said would seat 210 passengers and serve the Asia-Pacific region. The planned longer version takes aim at the Airbus A321neo and Boeing’s upcoming 737 MAX 10 – the top end of the single-aisle market where Airbus and Boeing are battling for the most hotly contested orders. COMAC also displayed its regional C909, China’s first jet-engine-powered plane to reach commercial production, which has been in service since 2016.

Brunei last month became the latest country to allow its airlines to operate Chinese-made aircraft and its startup GallopAir ordered 15 C909s and 15 C919s in 2023.

However, neither model has won a major global customer.

Boeing Commercial Airplanes CEO Stephanie Pope welcomed COMAC’s arrival but pledged to maintain an edge through continued innovation.

“Competition is great for the industry. It’s great for Boeing. It makes us all better,” she told Reuters.

Airbus commercial CEO Christian Scherer told Reuters: “It is not a threat; it is a competitor, it is a reality.”

Analysts do not expect China to take a significant slice of the global jet market beyond deals with supportive countries any time soon but say its presence is a clear signal of its ambition to penetrate one of the last bastions of Western manufacturing.

While COMAC’s advertising materials stressed intellectual property was held in China, a C919 brochure listed 18 Western suppliers for systems ranging from engines to landing gear.

Its reliance on Western parts was highlighted during trade tensions between Beijing and Washington earlier this year when the U.S. halted export licences for engines.

COMAC said in a statement it “remains committed to open cooperation and looks forward to building closer, stronger, and deeper relationships with global customers and partners”. Gulf countries have strong ties with China, the biggest trading partner for both Saudi Arabia and the UAE, which have welcomed cooperation with Chinese firms in recent years.

This year, COMAC has fallen behind on previously stated delivery targets for its narrow-body C919, according to regulatory filings from the three airlines that fly it.

The company also displayed materials outlining its planned C929 wide-body jet – originally co-developed with Russia and now driven solely by COMAC – but with scarce technical details

(Editing by Adam Jourdan, Joe Bavier and Alexander Smith)