By Karen Brettell

NEW YORK (Reuters) -The Swiss franc gained on Friday as a global stock market selloff sent investors to safe havens, while the pound weakened after a report the UK budget will not include income tax rises.

Rising expectations that the Federal Reserve will hold rates steady in December instead of continuing to ease have dented risk appetite.

More Fed officials signalled caution on Thursday over further easing, citing worries about inflation. Investors now see a 50% chance of a 25-basis-point cut in December.

Kansas City Fed President Jeffrey Schmid on Friday said his concerns about “too hot” inflation go well beyond the narrow effects of tariffs alone, in fresh remarks that signaled he could dissent again at the Fed’s December meeting should policymakers opt to cut short-term borrowing costs again.

Traders are preparing for an avalanche of economic reports that were delayed by the U.S. federal government shutdown, but which will likely include crucial gaps for October, when the data wasn’t collected.

Markets are “disjointed because of the lack of data and the people reacting to the Fed speakers,” said Lou Brien, strategist at DRW Trading in Chicago.

The Commerce Department’s Bureau of Economic Analysis said on Friday it was working to update its schedule of economic data releases affected by the recently ended government shutdown.

If data shows further labor market weakness, the dollar may resume its weakening trend from earlier this year as traders reprice for more rate cuts.

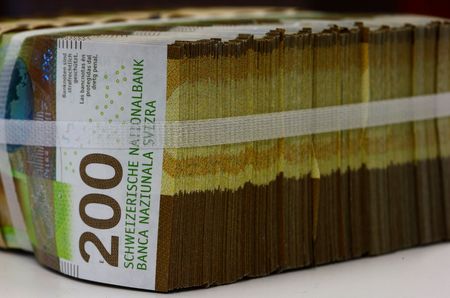

SAFETY IN SWITZERLAND

The euro was last down 0.2% and got as low as 0.9177 francs, its lowest since 2015’s dramatic swings when Swiss authorities de-pegged their currency from the euro.

The dollar weakened 0.04% to 0.793 francs.

Meanwhile the United States will slash its tariffs on goods from Switzerland to 15% from a crippling 39% under a new framework trade agreement, the Swiss government said on Friday.

The Japanese yen strengthened 0.14% to 154.31 per dollar but remains in sight of the nine-month low against the greenback it hit just a few days ago.

The euro fell 0.11% to $1.1618.

Typically, higher U.S. yields and a stock market selloff would see investors rush to the greenback. Earlier this year during the turmoil sparked by U.S. President Donald Trump’s tariff announcements, however, the dollar fell alongside stocks and bonds.

“I think we’ve learned something about dollar positioning from this,” said Jane Foley, head of FX strategy at Rabobank.

She said markets which had been short dollars after the tariff turmoil had been gradually covering those positions.

“And then this week, because the market was no longer short, they were rebuilding those again, so there has been a lot of position adjustment going on, which has meant it’s very difficult to judge the normal reaction,” Foley said.

UK TURMOIL

The pound tumbled against both the dollar and the euro after media reports, including from Reuters, that British Prime Minister Keir Starmer and Finance Minister Rachel Reeves have abandoned plans to raise income tax rates, marking a sharp shift just weeks ahead of the November 26 budget.

The British currency was last down 0.33% at $1.3146. The euro hit its highest rate to the pound since April 2023.

In cryptocurrencies, bitcoin was caught up in the risk-off mood as well. It fell 2.55% to $96,286, its lowest since May.

(Reporting by Rae Wee; Editing by Raju Gopalakrishnan, Susan Fenton, Philippa Fletcher)