By Rae Wee and Alun John

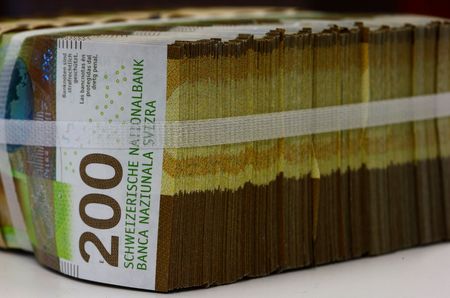

SINGAPORE/LONDON (Reuters) -Currency markets swirled on Friday as a selloff in stocks sent investors to the safe-haven Swiss franc, which hit its strongest to the euro since 2015, while the pound was hurt by a report the UK budget this month will not see expected income tax rises.

There are multiple cross currents in markets at present, but most fundamentally, the moves come as traders now see a Federal Reserve rate cut in December as much less likely than they did a few weeks ago.

More Fed officials signalled caution overnight over further easing, citing worries about inflation and signs of relative stability in the labour market.

Investors now see just over a 50% chance of a 25-basis-point cut in December, although odds for such a move in January are almost fully priced.

That shift sparked a sell off in richly-valued stocks and government bonds in the U.S. which spilled over into Asia and Europe, while, in currency markets, it had the effect of sending people to the Swiss franc.

SAFETY IN SWITZERLAND

The euro dropped to as low as 0.9184 francs, its lowest since 2015’s dramatic swings when Swiss authorities de-pegged their currency from the euro.

The common currency was last down 0.18% at 0.9206 francs, while the dollar hit a one-month low, and was last down 0.1% at 0.7920 francs.

The dollar itself was oddly less moved by all the drama, trading flat against a basket of six peers at 99.26. The index hit a six-month high last month, although it is down about 0.3% on the week.

Versus the euro, the greenback was a fraction stronger at $1.1621 to the common currency.

Typically, higher U.S. yields and a stock market selloff would see investors rush to the greenback, while earlier this year, during the turmoil sparked by U.S. President Donald Trump’s tariff announcements, the dollar fell alongside stocks and bonds.

“I think we’ve learned something about dollar positioning from this,” said Jane Foley, head of FX strategy at Rabobank.

She said markets which had been short dollars after the tariff turmoil had been gradually covering those positions.

“And then this week, because the market was no longer short, they were rebuilding those again, so there has been a lot of position adjustment going on, which has meant it’s very difficult to judge the normal reaction.”

Further complicating the picture are attempts by markets to predict what U.S. economic data will say when it is released after the U.S. shutdown lifts.

The White House indicated the U.S. unemployment rate for October may never be available, since it is dependent on a household survey that was not conducted during the shutdown.

UK TURMOIL

Elsewhere, the pound tumbled against both the dollar and the euro after a report by the Financial Times that British Prime Minister Keir Starmer and Finance Minister Rachel Reeves have abandoned plans to raise income tax rates, marking a sharp shift just weeks ahead of the November 26 budget.

It was down as much as 0.5% on the dollar at one point and was last down 0.3% at $1.3155. The euro hit 88.64 pence, its highest to the pound since April 2023.

British government bond prices and British stocks also fell.

In Asian markets, it was a busy day for currencies. The South Korean won jumped 1% against the dollar after the country’s foreign exchange authorities vowed to take measures to stabilise a wobbly currency and were suspected of dollar-selling market intervention.

The battered yen meanwhile found some reprieve thanks to the pullback in the dollar, although it remained pinned near a nine-month low hit earlier this week.

It was last at to 154.7 per dollar, but remained on track for a fall of 0.8% for the week.

In China, the onshore yuan peaked at a one-year high of 7.0908 per dollar, with traders citing dollar-selling by local exporters after the currency pair breached a key threshold. [CNY/]

(Reporting by Rae Wee; Editing by Sam Holmes, Lincoln Feast, Raju Gopalakrishnan)