By Leika Kihara

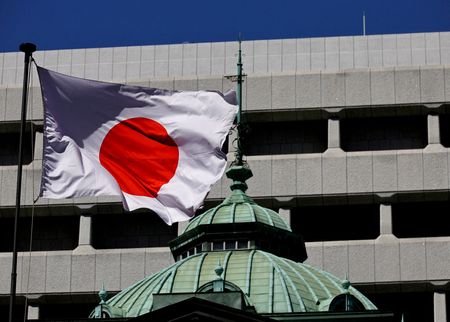

TOKYO (Reuters) -A growing number of policymakers at the Bank of Japan believed that conditions were falling into place for interest rates to rise, with two members advocating an immediate increase, minutes of the central bank’s September meeting showed on Wednesday.

At the two-day meeting through September 19, the nine-member board kept interest rates steady at 0.5%, turning down proposals made by two hawkish members to raise borrowing costs to 0.75%.

In a sign the focus of debate was shifting towards the exact timing of the next rate hike, several members said it would not be too late to await “a little more hard data,” the minutes showed.

“Although conditions needed for raising rates were gradually being met, hiking rates at this point would come as a surprise to the market and should be avoided,” another member was quoted as saying.

A third member cited uncertainty over the U.S. economic slowdown as a reason to hold off hiking rates, but added it might be time to consider raising rates again “judging solely from the perspective of Japan’s economic conditions,” the minutes showed.

The minutes highlight a growing momentum within the board towards resuming rate hikes as concerns recede that higher U.S. tariffs could derail Japan’s fragile economy.

While the BOJ kept rates steady again at a subsequent meeting in October, Governor Kazuo Ueda sent the strongest signal to date that a hike was possible as soon as December.

The minutes revealed that board members debated the pros and cons of waiting, as members weighed downside risks to growth and inflationary pressure from stubbornly high food costs.

One member called for raising rates at “somewhat regular intervals”, stating that a wide range of information would be available such as corporate first-half earnings, full-year earnings outlook and the BOJ’s “tankan” business survey.

Another member said that while waiting longer to raise rates would give the BOJ additional insight into the U.S. economic outlook, the cost of doing so would “gradually increase”, the minutes showed.

Doves, however, warned of Japan’s long experience with deflation as a reason to go slow with one pointing to the fact that inflation expectations have yet to be anchored at the central bank’s 2% target, the minutes showed.

“As long as inflation expectations were considered to be not well anchored, it was appropriate for the BOJ to maintain accommodative financial conditions as much as possible,” the member was quoted as saying.

Last year, the BOJ exited a decade-long, massive stimulus programme. It raised rates to 0.5% in January on the view Japan was close to durably hitting its 2% inflation target. It has kept interest rates steady since then.

Core consumer inflation has exceeded the BOJ’s target for more than three years, but Ueda has stressed the need to tread cautiously until underlying inflation – or price moves excluding one-off factors – stabilises around 2% backed by sustained wage gains.

(Reporting by Leika Kihara; Editing by Himani Sarkar and Jacqueline Wong)