By Trevor Hunnicutt and Eduardo Baptista

ABOARD AIR FORCE ONE/GYEONGJU (Reuters) -U.S. President Donald Trump may have teased that he could discuss Nvidia’s state-of-the-art artificial intelligence Blackwell chips with Chinese President Xi Jinping, but in the end, he said the topic did not come up.

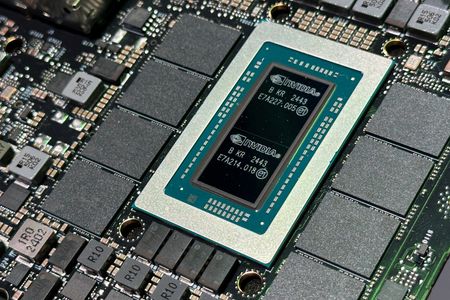

After Thursday’s meeting in South Korea, Trump told reporters aboard Air Force One that semiconductors had been discussed and China was “going to be talking to Nvidia and others about taking chips”, but added: “We’re not talking about the Blackwell.”

A day earlier, Trump had praised the Blackwell chip as “super-duper”, adding he might speak to Xi about it, in comments that probably helped Nvidia make history as the first company to reach a $5-trillion valuation.

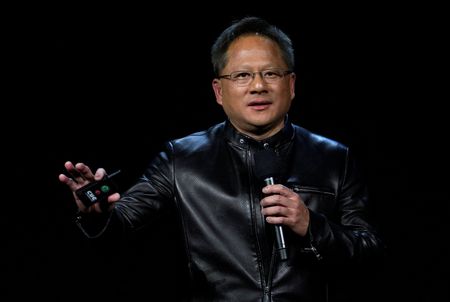

Speaking in Seoul on Thursday evening, Nvidia CEO Jensen Huang said the talks between Washington and Beijing were in the hands of Trump and Xi.

“As you know, he is the great negotiator and a great deal maker, and President Xi, the two of them have an excellent relationship,” Huang said.

“It’s completely in their hands, and I have every confidence they’re going to do everything they can to make the best deals for their own countries.”

Huang, dressed in his signature black leather jacket, said he was honoured that his company was the first in history to reach $5 trillion and he believed there was still room to grow.

THORNY TOPIC

The extent of China’s access to Nvidia’s chips has been a key point of friction with the United States.

Washington imposes export controls on sales of Nvidia’s most advanced AI chips to China, seeking to limit its tech progress, particularly in applications that could help its military.

Nvidia’s Huang has tried to persuade the Trump administration to loosen the controls, saying Chinese AI’s dependence on U.S. hardware was good for America.

Nvidia has been working on a new chip for China based on its latest Blackwell architecture that will be less capable than the model sold outside the country but more powerful than the most advanced model it is currently allowed to sell there, the H20, sources have previously said.

But while private Chinese companies are believed to be very interested in purchasing such a chip, the government has turned cool towards Nvidia, discouraging purchases of the H20, and is instead promoting domestic chip manufacturers such as Huawei.

Huang said this week his company had not sought U.S. export licenses to send its newest chips to China because of the Chinese stance.

“They’ve made it very clear that they don’t want Nvidia to be there right now,” he said during a developers’ event, adding that it needed access to the China market to fund U.S.-based research and development.

On Thursday at least, Trump did not appear to want to get into the thick of the issue.

“I said (to Xi) that’s really between you and Nvidia, but we’re sort of the arbitrator or the referee,” he said.

Lawmakers, both Democrat and Republican, have expressed opposition to giving China more access to advanced chips like Nvidia’s Blackwell.

Nvidia declined to comment.

An account of the meeting published by Chinese official news agency Xinhua did not mention chips, but cited Xi as saying that both sides had good prospects for cooperation in AI.

CONTINUED UNCERTAINTY

The Trump administration initially banned exports of Nvidia’s H20 chip to China in April, a decision it reversed in July, saying it had struck a deal with Nvidia to grant export licenses in exchange for 15% of Chinese sales of the H20.

But as the U.S. loosened the screws on Nvidia, Beijing tightened them. In the past two months, its regulators have asked the U.S. chipmaker to explain whether the H20 chip posed backdoor security risks and cautioned domestic firms over purchases.

At a Citadel Securities event this month, Huang bemoaned that the tit-for-tat actions had slashed Nvidia’s market share for advanced AI chips in China from 95% in 2022 to virtually zero.

U.S. Trade Representative Jamieson Greer, also speaking aboard Air Force One, said that after Trump’s meeting with Xi, Nvidia would talk to China and see what was possible.

“There’s so many chips we already sent to China, a lot of advanced chips.”

But two people familiar with discussions in the Chinese market said they were skeptical that Beijing would quickly change its stance on Nvidia chips, adding that China did not want to settle for inferior chips since the H20 was far behind the Blackwell in performance and it believed that domestic rivals could catch up with the H20 soon.

One said they would still be willing to consider the downgraded version of the Blackwell chip, dubbed the B30A, if Washington approved its sales to China.

The sources spoke on condition of anonymity as the situation is a sensitive one.

(Reporting by Trevor Hunnicutt and Eduardo Baptista; Additional reporting by Fanny Potkin, Che Pan, Heekyong Yang and Hyunjoo Jin. Writing by Eduardo Baptista. Editing by Clarence Fernandez and Mark Potter)