By Olivier Cherfan

(Reuters) -French industrial gases group Air Liquide on Tuesday confirmed its 2026 margin outlook and reported quarterly sales in line with expectations, supported by growth in the Americas, as well as its healthcare and industrial merchant (IM) divisions.

The company, which supplies gases such as oxygen, nitrogen and hydrogen to factories and hospitals, said its sales rose 1.9% on a comparable basis to 6.60 billion euros ($7.70 billion) in the June-September period compared to a year earlier.

The company still expects to further raise its margin and deliver recurring net profit growth at constant exchange rates this year, and to increase its operating margin by +460 basis points cumulated by end-2026, it said.

Shares in Air Liquide rose 1.4% at 0711 GMT.

J.P. Morgan deemed the update “decent”, while noting that the new investment project backlog, a proxy for mid‑term growth, hit a record level of 4.9 billion euros, up from 4.6 billion euros at the end of the second quarter.

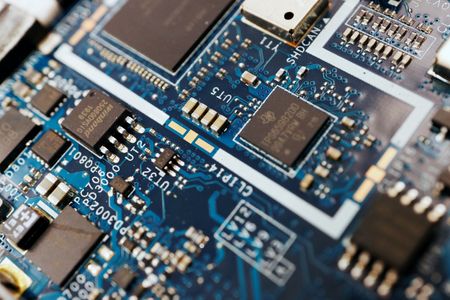

Air Liquide is capitalizing on the AI boom, agreeing in August to buy South Korea’s DIG Airgas for €2.85 billion, its largest deal since Airgas in 2016, and committing $250 million to an Idaho plant for Micron’s advanced memory lines, as peers like Linde expand semiconductor gases as data centers built for generative AI drive global demand for ultra‑pure gases.

Sales at Air Liquide’s gas and services business, accounting for 97% of the group’s total revenues, were up 1.9% on a comparable basis to 6.39 billion euros and 4.8% in the Americas, while IM rose 4.9%.

Analysts polled by Vara Research were expecting sales at 6.59 billion euros on average.

($1 = 0.8575 euros)

(Reporting by Olivier Cherfan in Gdansk, editing by Matt Scuffham)