By Jamie McGeever

ORLANDO, Florida (Reuters) -TRADING DAY

Making sense of the forces driving global markets

By Jamie McGeever, Markets Columnist

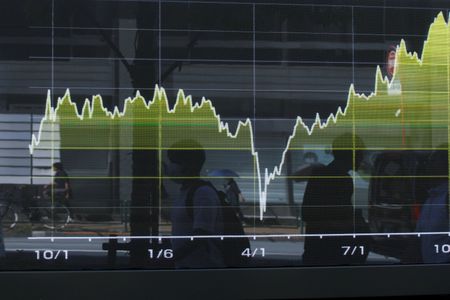

A burst of profit-taking and economic jitters knocked U.S. and world stocks off their record-high perches on Tuesday as investors digested the ongoing political gridlock in the U.S. and France, while gold futures reached the landmark $4,000 an ounce level.

More on that below. In my column today I look at the asymmetric risks in the Fed’s easy policy stance. Chair Jerome Powell says rate cuts are needed to support the creaking labor market, but that may be questionable. What’s less debatable is the whoosh they are giving to already booming asset prices.

If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today.

1. Forget recession, world economy is being run ‘hot’: MikeDolan 2. White House says no shutdown-related layoffs yet, butwarns they could come 3. OpenAI declares ‘huge focus’ on enterprise growth witharray of partnerships 4. Private credit cash pivots from ‘risky’ West to emergingmarkets 5. Wall Street’s trading shuffle bankrolls the casino

Today’s Key Market Moves

* STOCKS: Wall Street indices down between 0.2% (Dow) and1.1% (Russell 2000). Japan’s Nikkei ekes out new high. * SHARES/SECTORS: U.S. biggest sector movers are consumerdiscretionaries -1.4%, consumer staples +0.9%. AMD shares addanother 4%. * FX: Dollar hits 6-week high. Japan’s yen extends slide -USD/JPY 152.00, EUR/JPY at new high of 177.00. Hungary’s forintsinks 2%, bitcoin -3%. * BONDS: Japanese 30-year yield hits new record high3.345%. U.S. Treasury yields down 2-4 bps across the curve.3-year auction is well-received. * COMMODITIES: U.S. gold futures hit $4,000/oz for thefirst time.

Today’s Talking Points:

* U.S. bank reserves below $3 trillion

U.S. bank reserves held at the Fed are below $3 trillion for the first time since January – down nearly $300 billion since late August – a clear sign that excess liquidity is being drained from the system.

There’s nothing magical about the $3 trillion figure, and it is probably well above the unknowable level where officials reckon reserves are still “ample”. But it brings into focus Fed QT and the question of how low can reserves go without sparking liquidity concerns. Fed Governor Christopher Waller has said $2.7 trillion might hypothetically be an ideal level. It’s not far away.

* Bond blues

Sovereign debt markets around the world are under heavy pressure, particularly the long end of the curve, where yields have recently shot up to historic highs in many countries. And in the case of Japan, record highs.

There was some respite for U.S. Treasuries on Tuesday, but the backdrop remains challenging. Policymakers are running economies hot with monetary and fiscal easing, just as financial markets are booming and inflation is above target. Right now, investors are more inclined to sell any rip than buy any dip.

* Nothing’s gonna touch you in these golden years

Gold futures reached $4,000 an ounce on Tuesday, and the spot market price got to within $10 of that landmark level. Bullion has climbed 20% in just six weeks, and is up more than 50% this year.

The rally must run out of steam soon, right? Perhaps. But as talk of ‘debasement’ trades continues to percolate, and central banks continue buying, it’s not clear what that catalyst is or when it appears.

Easy Fed risks pouring fuel on ‘everything’ rally

The Federal Reserve says its interest rate cuts are aimed at softening the impact of a looming labor market rupture. Unfortunately, cheaper money is unlikely to achieve that goal, but what it almost certainly will do is fuel the “everything” rally in financial assets.

The reasoning posited by Chair Jerome Powell and the bevy of doves on the Federal Open Market Committee for pre-emptive easing is sound enough. Job growth is evaporating, which risks triggering a spiral of surging unemployment, lower consumption, and slower growth or even recession.

The problem is the Fed’s go-to tool in its armory – the federal funds policy rate – is a blunt one. This has always been true, but the risks in using it now are particularly asymmetric and increasingly skewed towards unwanted outcomes.

This is partly down to the imbalances that have taken root across corporate, economic and financial America. Consumption is driven by the richest households, who own most of a booming Wall Street, where profits, investment and market cap are dominated by a handful or two of megacompanies.

The Fed is easing monetary policy with U.S. financial conditions the loosest in over three years, credit spreads the tightest since 1998, inflation a percentage point above target, and GDP growth running at an annualized rate of around 3% or higher.

In financial markets, the “everything” rally is in full flow – Wall Street’s big three indices, the Russell 2000 small-cap index, the tech sector, semiconductor stocks, gold, and bitcoin are all at record highs.

Powell did say late last month that equity prices were “fairly highly valued”, perhaps echoing former Fed Chair Alan Greenspan’s 1996 speech highlighting “irrational exuberance” in markets at that time. It’s worth remembering, however, that the S&P 500 subsequently doubled and the Nasdaq quadrupled in value before peaking in March 2000.

There’s no suggestion a similar boom – or bust – is on the cards. But because the wealth effect seems so prevalent, perhaps the Fed should be factoring financial market conditions into their decision-making more than they have in the past.

IT’S A ‘LOW-HIRE, LOW-FIRE’ LABOR MARKET

Yet that doesn’t appear to be the case. The Fed has shifted its focus towards the employment side of its dual mandate, but it’s not clear how fragile the labor market really is.

Much of the recent spike in jobless claims can be traced to one-off weather events in certain states and, more importantly, one of the main reasons job growth has slowed is the Trump administration’s immigration and deportation policies.

Even though policymakers’ concerns may be justified, labor dynamics today are different from years gone by. It is a “low-hire, low-fire” job market – job growth is clearly slowing, but labor supply is shrinking too.

The nonpartisan Congressional Budget Office last month revised down its January estimates of net immigration this year by 1.6 million, and lowered next year’s forecast by almost 1 million.

This has helped slash the monthly breakeven rate of job growth needed to keep the unemployment rate steady to well below 50,000, according to St. Louis Fed estimates, from over 150,000 at the start of the year.

And it’s worth remembering that the unemployment rate is still a historically low 4.3%. It’s unclear whether rate cuts, even the additional 100 basis points futures markets expect by the end of next year, will encourage businesses to hire more workers in this environment.

As economists at BlackRock point out, that degree of easing is typically associated with a much starker weakening of the labor market, inflation, and growth, none of which looks certain or even likely at this juncture.

BlackRock economists’ base case scenario is what appears to be playing out right now – resilient household incomes spurring a revival in consumer spending, and the wave of AI-related investment in tech equipment, software and data centers powering growth. Markets are reacting accordingly.

According to Chair Powell, the Fed’s policy stance is “modestly restrictive”, that is, close to neutral. On balance, further easing probably risks overheating Wall Street more than having a discernible positive effect on the labor market.

What could move markets tomorrow?

* New Zealand interest rate decision * Japan Tankan index (October) * Japan current account (August) * Germany industrial production (August) * Bank of England chief economist Huw Pill speaks * ECB President Christine Lagarde speaks * U.S. Treasury auctions $39 billion of 10-year notes * U.S. Federal Reserve minutes from September 16-17 meeting * U.S. Federal Reserve officials scheduled to speak includeDallas Fed’s Lorie Logan, Minneapolis Fed’s Neel Kashkari,Chicago Fed’s Austan Goolsbee, and Governor Michael Barr

Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

(By Jamie McGeever;)